PCB EPF SOCSO EIS and Income Tax Calculator 2022. In 2016 and 2019 average income recipients in Malaysia was 18 persons.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable. Total income - tax exemptions and reliefs chargeabletaxable income. Expatriates that have been working in Malaysia for longer than 182 days in a year are considered tax resident.

So the more taxable income you earn the. Malaysia Monthly Salary After Tax Calculator 2022. Similarly you must pay the tax for income.

Regardless of your nationality if you stay in Malaysia for less than 182 days you are a non. Your tax rate is calculated based on your taxable income. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your.

This will be in effect from 2020. As an example lets say your annual taxable income is RM48000. However non-residing individuals have to pay tax at a flat rate of 30.

Our calculation assumes your salary is the same for 2020 and 2021. The rates vary for non-residents. Review the 2020 Malaysia income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other.

Taxable income band MYR. Remember that R is the percentage of tax rate which is a fixed 15 for a KWASR. Taxable income band MYR.

Review the 2022 Malaysia income tax rates and thresholds to allow calculation of salary after tax in 2022 when factoring in health insurance contributions pension contributions and other. This means that low-income earners are imposed with a lower tax rate. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

Taxable income band MYR. Expatriates that are seen as residents for tax purposes will pay. Additional rates will be implemented in case of special instances of.

Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640. Verify the PCB amount with an LHDN-approved HR tool. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Taxes for Year of Assessment 2021 should be filed by 30 April 2022. Overall income that is earned by household members whether in.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

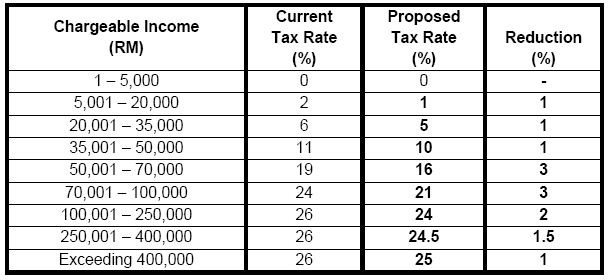

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Budget 2014 Personal Tax Reduced In 2015 Tax Updates Budget Business News

Individual Income Tax In Malaysia For Expatriates

Malaysia Budget 2021 Personal Income Tax Goodies

7 Tips To File Malaysian Income Tax For Beginners

How To Calculate Foreigner S Income Tax In China China Admissions

Malaysian Personal Income Tax Pit 1 Asean Business News

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

10 Things To Know For Filing Income Tax In 2019 Mypf My

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook